The AI Platform That Automates

Your Most Time-Intensive Workflows

From sales outreach to loan origination to enterprise knowledge — Corepass replaces manual, operational busywork with AI-driven automation so your team can focus on growth, not grunt work.

Trusted by leading companies

The Corepass AI platform

One Platform, Three Powerful Solutions

Built for the most operationally heavy parts of your business

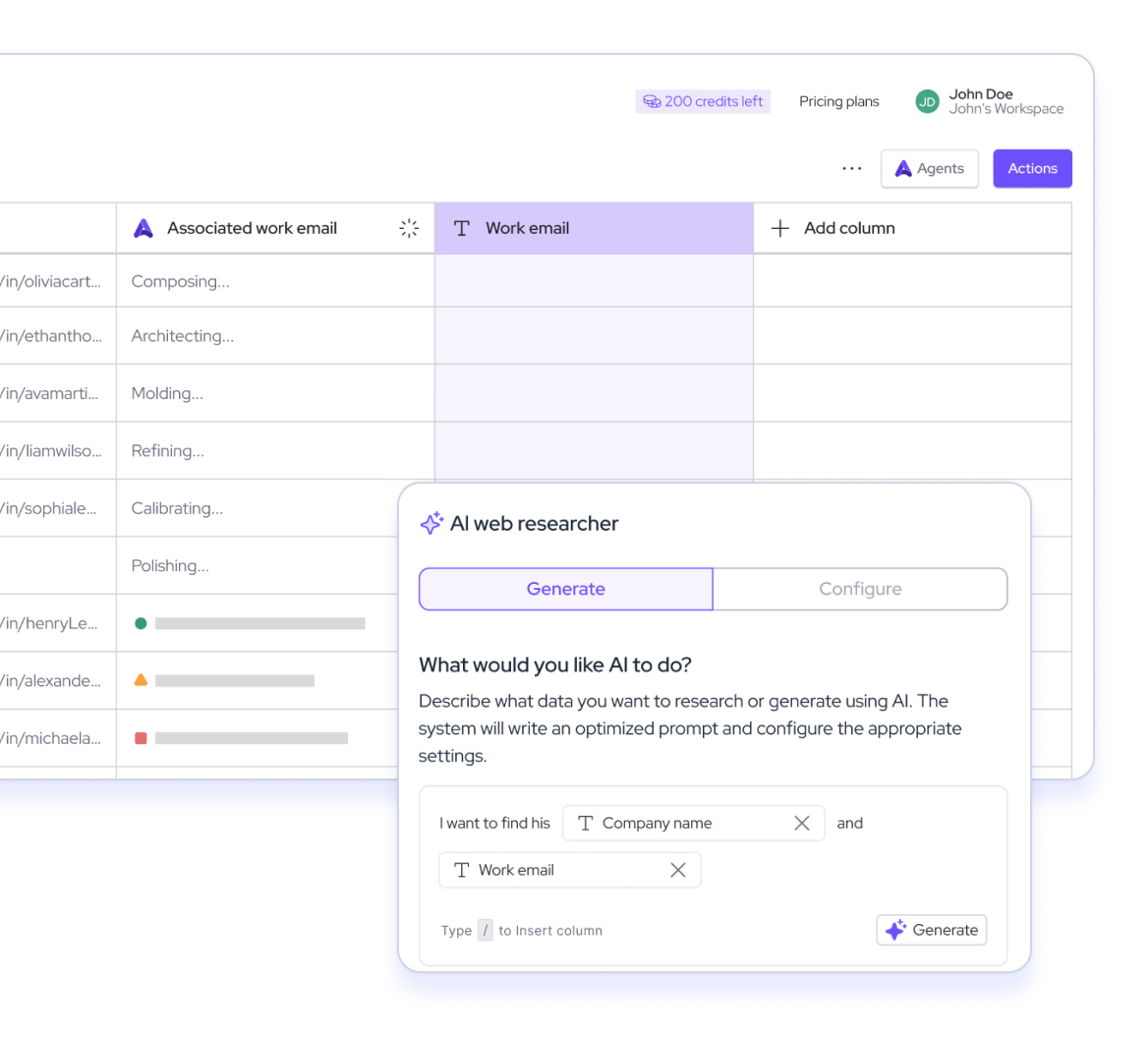

SalesOS

Book More Meetings,

With Less Manual Work

AI research + outreach agent finds, enriches, and contacts leads automatically.

Book more meetings and let your team focus on closing deals—not prospecting

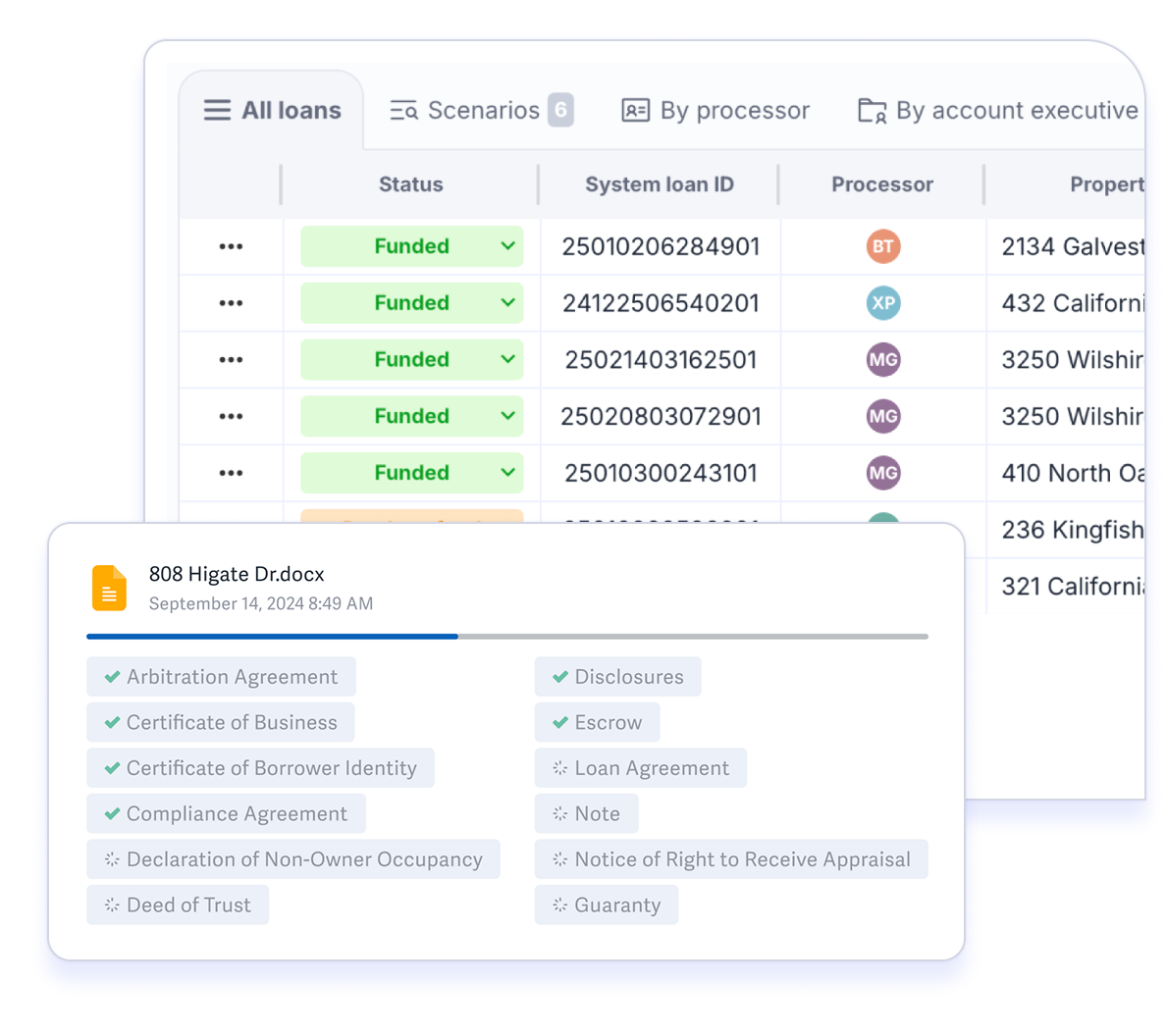

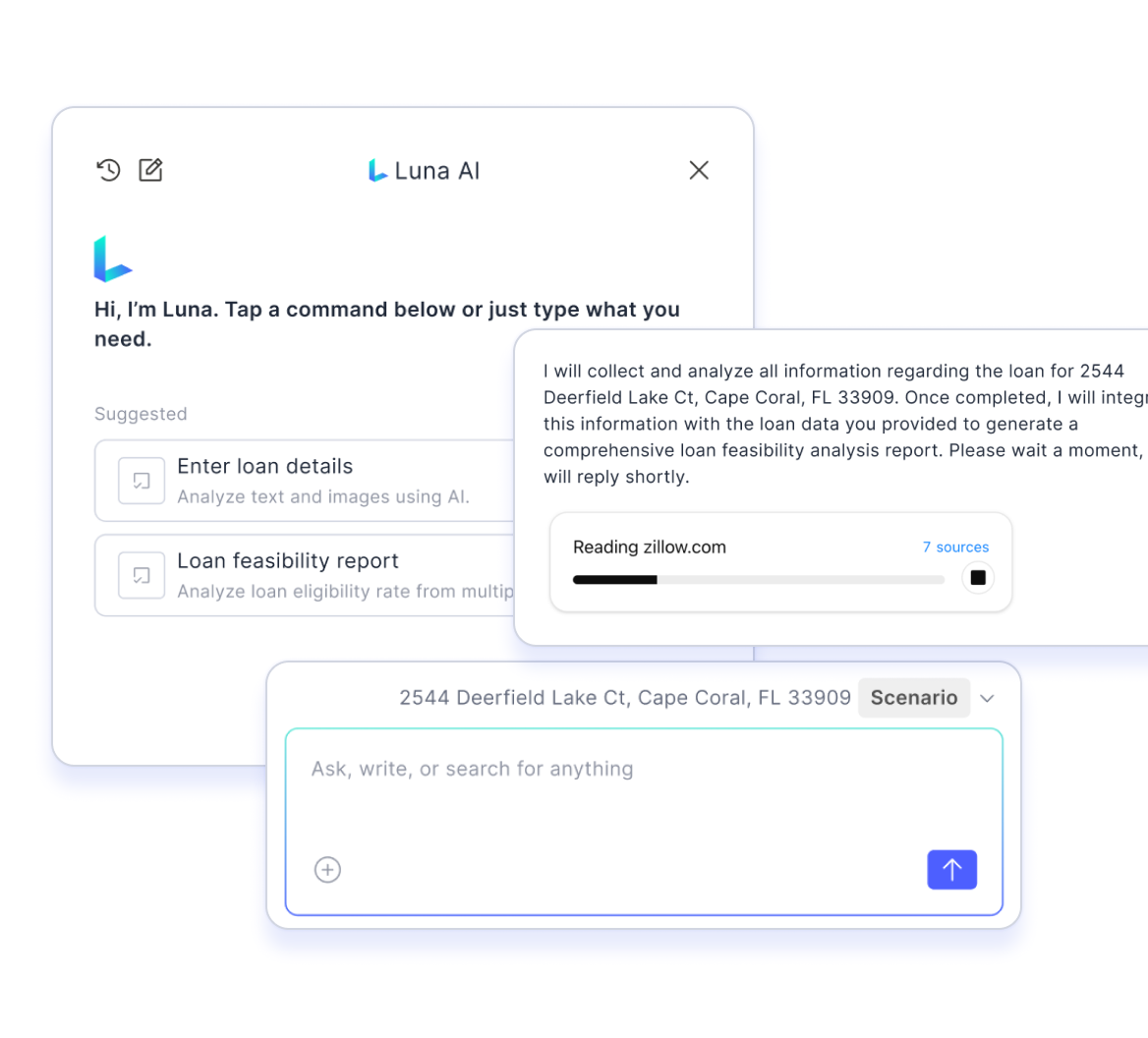

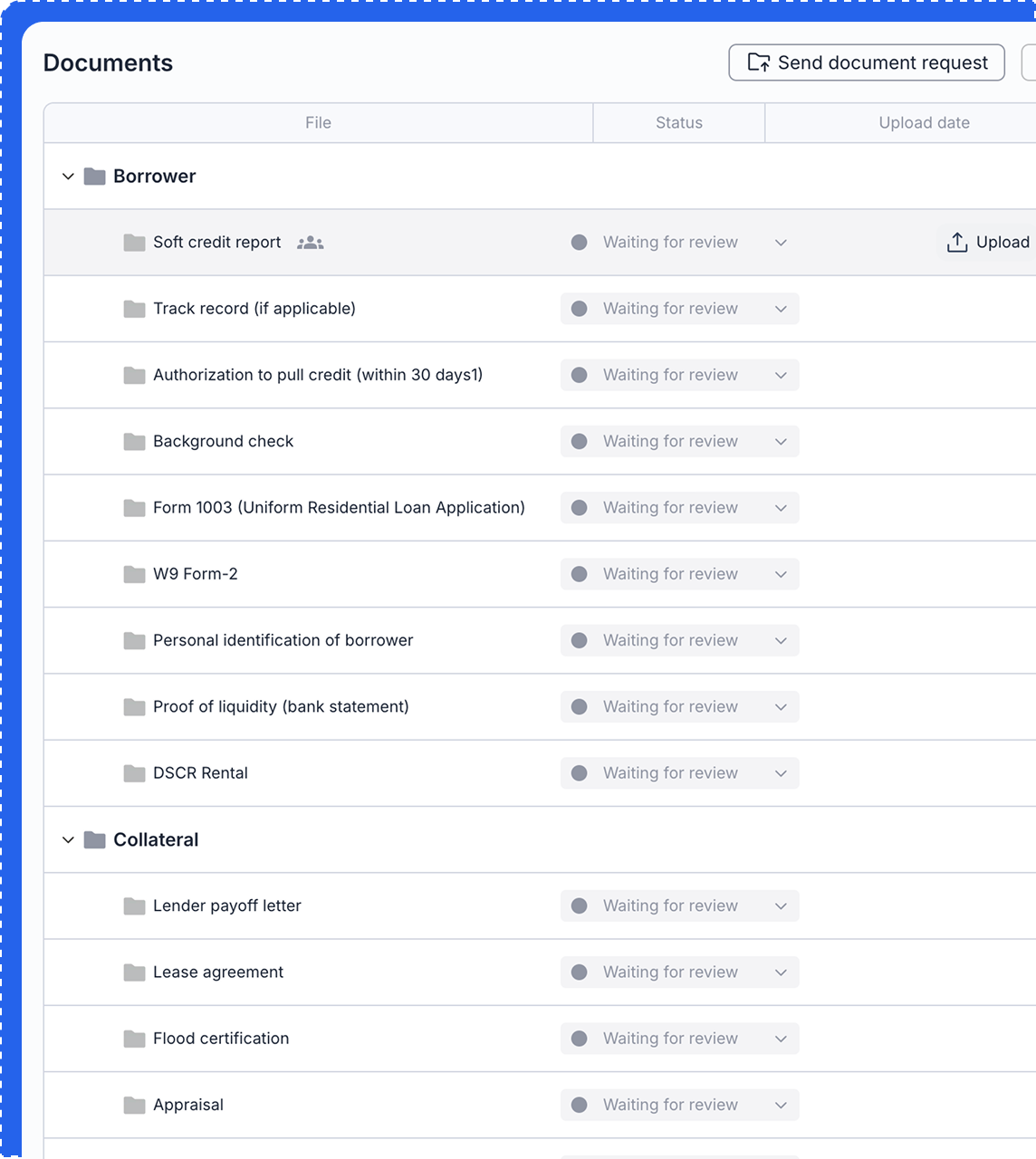

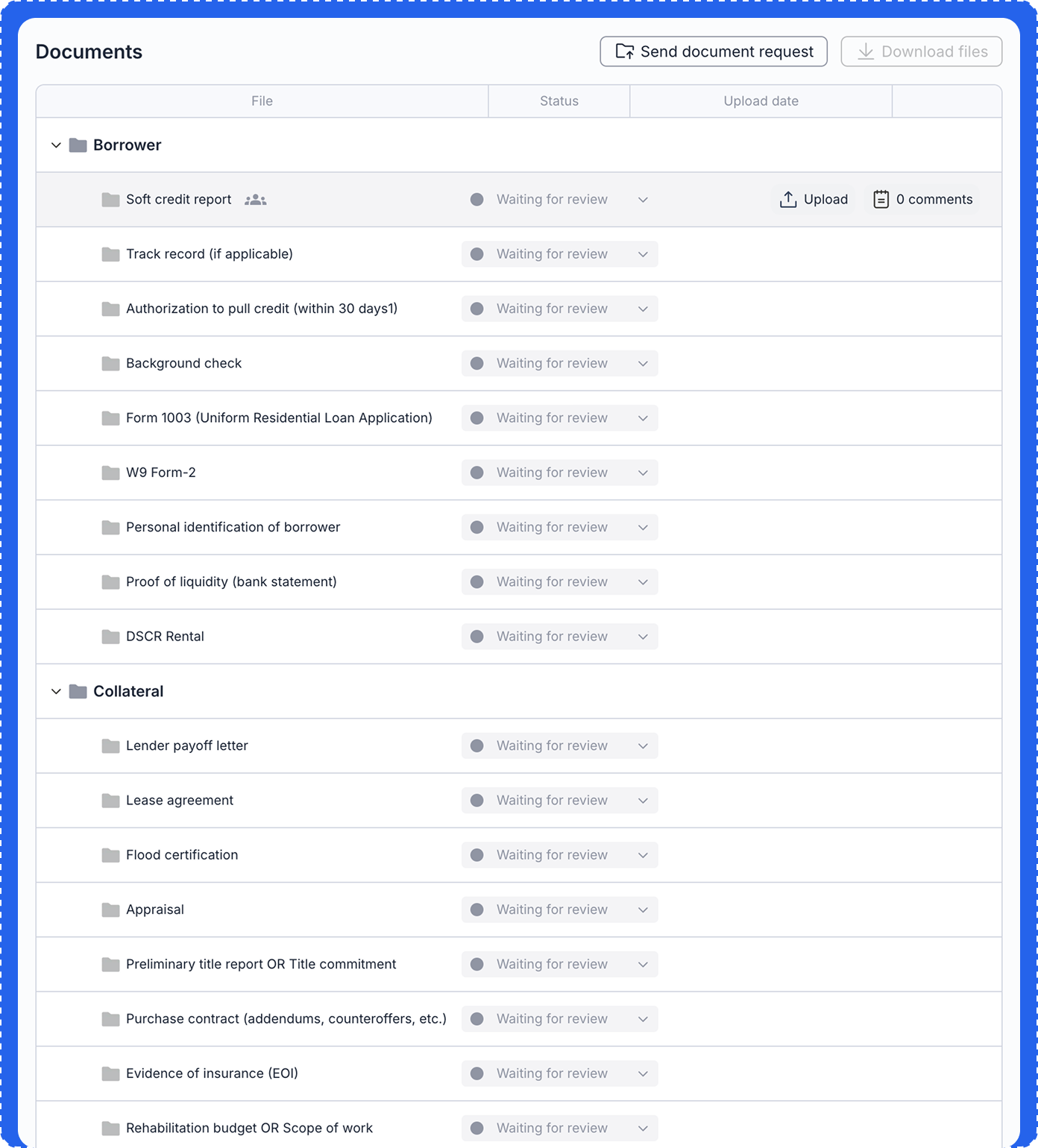

LendingOS

AI-Powered Lending OS

- Handles borrower intake, document generation, pipeline tracking, and pricing automation.

- Connects to existing email, and document tools—no rip-and-replace needed.

- Automates repetitive steps while keeping underwriting decisions human-controlled.

KnowledgeOS

AI-Powered Company Brain

- Centralizes documents, Slack threads, and notes into one searchable hub.

- Syncs with Dropbox, Google Drive, and Notion in real time — no manual updates.

- AI keeps knowledge summarized, indexed, and always up to date.

The Corepass Way

AI That Works The Way You Do

Our system centralizes your data, automates repetitive work, and adapts to your workflows—so your team can focus on closing deals, not juggling tools.

Centralize Everything in One Place

AI thrives on centralized data—Corepass makes it effortless.

- Data Hub for Sales & Ops: Bring your CRM, inbox, docs, and communication channels together.

- 3rd-Party Integrations: Works with tools your team already uses—Salesforce, HubSpot, Slack, Outlook, Dropbox, Google Drive.

Automate the Busywork, Keep Control of the Rest

AI Handles Repetition: Prospect research, contact enrichment, email drafting, follow-ups, and meeting scheduling.

Human-in-the-Loop: Reps still control tone, messaging strategy, and closing calls.

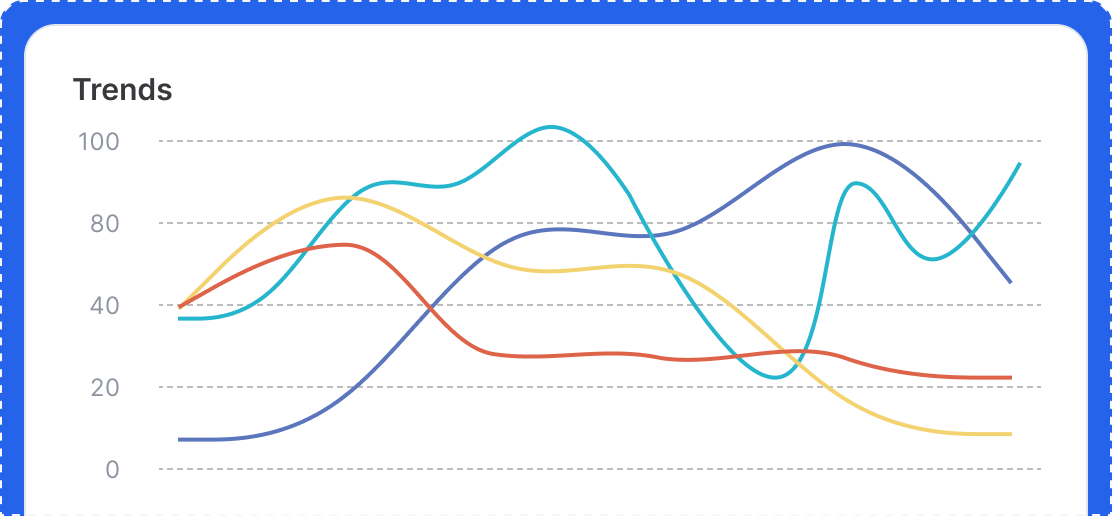

AI That Learns and Adapts

The longer you use Corepass, the better it becomes.

- Gets smarter with every sequence, dataset, and customer interaction.

- Learns your team’s style—improves email tone, prospect targeting, and decision-making over time.

The Future of Work, Powered by Corepass

Stop wasting human time on repetitive tasks. Let Corepass automate the work so your team can focus on strategy and growth.

What Our Customers Are Saying

From fast-growing originators to established lending firms, Corepass gives teams the tools they need to scale cleanly and close faster.

We doubled our loan volume without adding a single processor. Corepass automated document collection and status updates, freeing our team to focus on customer experience instead of chasing paperwork.

Our SDR team now books three times more meetings while doing half the manual work. Automated lead research and email outreach mean reps spend their time talking to qualified prospects, not copy-pasting data.

Research time has dropped by 60% since we started using Corepass. The answers we need are now available instantly across Slack, docs, and drives, so our team can make decisions faster and move deals forward.

We cut our application review time in half. Corepass centralizes documents and automates follow-ups, so our team spends more time approving loans and less time chasing paperwork.

Corepass helps us prioritize the right leads. Our conversion rate increased by 30% because reps can see which prospects are most likely to qualify and engage them faster.

Since adopting Corepass, onboarding new team members takes days instead of weeks. All workflows and data are in one place, so training is faster and more consistent.